Marc Hartog FCCA

Entrepreneur & experienced CEO/CFO/NED based in London.

Currently offering Fractional CFO & independent consulting services.

Recently launched Fractionality, a strategic CxO consultancy.

A bit about me.

My background is in finance, having qualified as an accountant a really, really (really) long time ago, but my passion is for business, art, media and, right now, in using my experience to help interesting businesses to scale or toward an exit outcome.

I have held various C-suite & Non-Executive directorships, alongside investing in / advising startups both in and outside of the media landscape, and I am humbled to have been awarded several accolades in recent years including the PPA’s Publishing Innovator of the Year (twice).

What I enjoy most is working with smart people to solve real world problems and finding creative ways to do things better.

I have two kids, a lovely wife and a gigantic dog who deserve my time in equal measure to my business commitments, and I try to bring a positive mental attitude to everything I do.

2012 - 2021

Work.

For close to a decade up to 2021 my main focus was 1854 Media, which I formed following a management buyout from Incisive Media, subsequently raising capital and building one of the most respected photography media organisations in the world.

Leveraging British Journal of Photography (BJP) as a core brand, we significantly enhanced the printed magazine and developed a large digital audience, created the most viewed exhibitions in the world, built an award-winning creative studio working with the likes of Disney and adidas as clients, and ultimately created a data-driven subscription business with a core membership designed to appeal to photographers of all levels.

“Marc is one of the most impressive, savvy, and hard-working entrepreneurs I’ve had the pleasure to work with.”

“Even in such a fiercely competitive category, our winner stood out for our judges for relentless innovation, courage, and commitment to the cause.”

1997 - 2012

Prior to 1854 Media I worked for Incisive Media, joining as employee number 25 and helping grow the business to, at it’s peak, a turnover of £250m with 2,000+ employees in offices all over the world.

During my 15 year tenure I held a variety of roles ranging from Group Finance Director with broad responsibility for technology and operations, to an M&A focused role seeing through major acquisitions and integrating the people, systems and cultures of the combined organisation. We also went through a full London Stock Exchange listing, a PE-backed management buyout, two reverse takeovers (as lead) and a number of reorganisations / divestments.

My final role at Incisive was a move to a more commercial environment, as Managing Director of its consumer portfolio, which was the catalyst preceding my buyout of BJP.

In 2022 I sold 1854 and launched ART3.io - a sideline experiment with a broad mission to explore photography in the Metaverse - which we did (during the brief NFT boom in 2022) through a combination of content, collaborating with artists & galleries to curate and promote exclusive NFT collections, and building virtual WEB3 exhibitions.

Where I have spent the majority of my time since late 2022 is working with a growing number of interesting businesses as their Fractional CFO, supporting leaders to achieve their goals, be it to scale, raise capital, prepare for an exit, or simply be more efficient.

More about my consulting services, including my current portfolio of technology businesses I work with, can be found here.

In 2024 I launched Fractionality, a Fractional CxO consultancy in order to broaden the offering and network of consultants available to help businesses reach their potential.

Now

“Brilliant at challenging set strategies and generating new ideas. Marc’s very focused, very aware; I was always inspired by how knowledgeable and connected he was with all things media but also beyond.

Jolly good to know.

Not all that great at golf.

Apparently.”

“OpenSea are excited to be partnering with ART3 to bring unique traditional photography to the blockchain”

Fractional CFO

In 2022 I discovered the Fractional way of working, and have not looked back. As Fractional CFO for a small portfolio of mostly technology businesses, I enjoy delivering them the value of the strategic support that they need, at a fraction of the cost of hiring an experienced CFO on a full time or interim basis.

We engage on a flexible basis which is designed so that my clients feel my presence most days, or know I am at the end of an email or call to help them toward their strategic goals - whether that be to deploy capital to scale and build the investor relationship, raise capital to grow, prepare for an exit, or simply to become more efficient.

If you are an entrepreneur, CEO or Managing Director running an ambitious company with fast growth potential, and looking to increase the rate of growth of your company to ensure you get the very highest price for it when/if you decide to sell, a ‘Fractional CFO’ model may well work for you.

My networks

I am the CEO of Fractionality Ltd, a growing network of world-class Fractional CFO’s, and am also a founding member of Fractional, the new CXO ‘board-as-a-service' consultancy. Until the launch of Fractional I was part of The CFO Centre, Europe’s largest fractional CFO network.

The Fractional model means that growing businesses can take on a high calibre C-suite executive for a fraction of the cost to appoint one on a full-time basis, with the added value of having access to a sophisticated advisory network.

My current portfolio

Fundpath: A critical data and business intelligence service disrupting the wealth and asset management industry.

Redmill Solutions: A specialist media data management company, working with some of the world's biggest advertisers.

Thermify: The smart green alternative to the residential boiler, deploying decentralised cloud computing serversto heat individual homes.

Neol Copper Technologies: A patented alternative to harmful additives found in lubricants in millions of engines around the world.

A few career highlights

〰️〰️

A few career highlights 〰️〰️

Raising capital + exits

One thing which I seem to be good at, is raising capital. Perhaps it is the combination of my finance background and education, coupled with real world experience of running, investing in and advising businesses, but I can put together a mean business plan and fundraising campaign. Throughout my career I have been involved in raising capital from crowdfunding via three successfully overfunded campaigns (>£2m raised), business angels and institutional investors, for a variety of different businesses.

I have also been involved in a number of exits - from companies I have founded as well as businesses where I sat on the board as chairman or in a Non-Executive capacity.

Some of these have been phenominal successes (>30x ROI), while others have not delivered returns to some investors but were the right strategic move - so I have broad experience of packaging and delivering narratives to investors and boards in various different scenarios.

One particular element of fundraising I have thoroughly enjoyed is equity crowdfunding, which I have successfully achieved three times for my own business ventures, and have also advised other businesses in this and other aspects of preparing for a fundraising campaign.

I have led every aspect of crowdfunding campaigns, from preparation of the business plan and data room, to scripting and creating the pitch videos, to creating a marketing campaign and building momentum in the build-up (FOMO stage), the fundraising window (execution stage), and crucially the immediate aftermath (consolidation phase).

It is a baring but rewarding experience which (if done right) can strengthen the board, the balance sheet & the team, and win a new cohort of ambassadors.

Portrait of Humanity

Portrait of Humanity was one of several major awards I conceptualized and led the development of, as part of 1854 Media’s awards program, which formed a cornerstone acquisition driver for the membership model (see ‘Subscription Machine’ section below). This project was a major undertaking, with an open submission to celebrate humanity through photography, in partnership with Magnum Photos and Clearchannel.

The first edition attracted more than 5,000 paid entries and the outputs included a global touring exhibition, alongside the 100 selected portraits being displayed internationally on Clearchannel outdoor advertising screens - making this exhibition the most viewed in history, seen by an estimated 50 million people.

We also sent the exhibition into Space!

I was interviewed on BBC World News about Portrait of Humanity, and Sky News about it's forebear Portrait of Britain, two of several live broadcast events about projects I have led, which include major awards and exhibitions shining a light on diversity, gender equality, and important topics such as climate change, while championing emerging artists - all of which formed part of the 1854 Access membership platform (see below).

Subscription machine

In a media environment where traditional revenue streams were in terminal decline and competition for attention was coming from all angles, we needed to think boldly and reinvent the core commercial model for 1854 Media.

Enter 1854 Access, a membership platform putting our community at the heart of the business, and actively turning our back on traditional advertising and newsstand circulation. A membership model with three cornerstones, inviting subscribers to get inspired with content, get seen by submitting to our growing awards portfolio, and get paid by applying for commissions to work with major international brands via our creative studio.

We built a data-driven subscription machine, with calls to action at every stage of the funnel for each of these three cornerstones, implementing marketing and anchor pricing strategies, alongside smart technology solutions, to drive acquisitions and ongoing engagement.

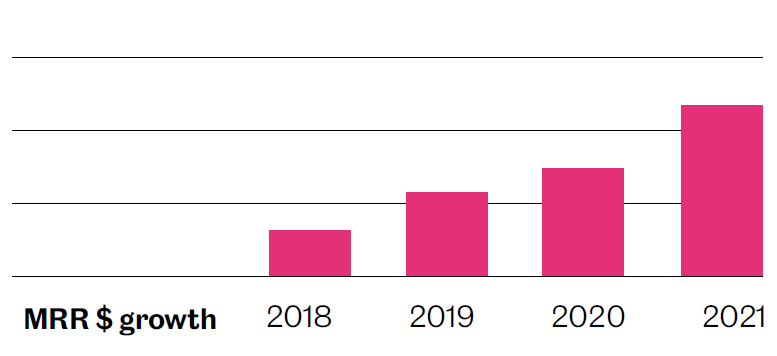

And it worked. In the two years since launching Access, subscription income more than tripled, becoming the primary revenue stream for the business, with funnel and north star metrics designed to bring together and focus editorial, marketing, technology and commercial priorities.

WEB3 innovation

In early 2021 I became interested in the advent of NFTs as a tool to bring together the artist and collector, and enable artists to earn royalties on the future value of their work - a long awaited technological means of disrupting an inefficient yet growing photographic art market.

Following some experimentation under the 1854 umbrella, two things became apparent. One, that this flawed early technology held the promise to be the opportunity in a generation for artists; Two, that this was a totally different business. This was the catalyst of selling 1854 Media to focus on ART3, and the beginning of a fascinating new adventure down the WEB3 rabbit-hole.

Since launching we have helped dozens of artists embrace the blockchain, quickly establishing ART3 as a source of inspiring content and high quality art, and partnering the biggest platform in the WEB3 space to present ART3’s NFT collections, generating $200,000+ in NFT sales. We also curated one of the most ambitious virtual exhibitions to date - Edition365.

While the current NFT collections remain live, during the prolonged winter for NFT markets, I am focused on my Fractional CFO service.

M&A + integration

During my time at Incisive Media, we undertook a large number of acquisitions, including two reverse takeovers. The company went through several chapters of ownership, including a full London stock exchange listing, a private equity backed MBO, and several refinancing events, until it came back in to private ownership shortly after I left in 2012 (and has subsequently been sold).

During this period I was involved in various aspects of the process as Finance Director of our UK and Asian operations, but felt that while we were very good at strategically identifying and acquiring great businesses, we were less good at efficiently integrating them to realise the synergies or growth opportunities which were the catalyst for the deal.

I pitched to the CEO that we needed someone to manage this process and (you guessed it) spent the next two years doing just that. Putting together an integration blueprint and coordinating multiple workstreams across the existing and newly acquired businesses, with a view to bringing together the best of the people, systems and cultures from both organisations. Each time we completed a deal my view was that we became a new organisation, particularly with significant USA and Asian expansion plans which were part of the strategy at the time.

This was a fascinating and challenging point in my career, which has helped to develop the open management style I operate - building an inclusive environment with people who are better at their roles than I could be, allowing them a large degree of autonomy while not tolerating office politics or a poor work ethic, and encouraging a sensible life:work balance to keep people loyal and motivated.

Star Wars

In a thirty year career there are many potential highlights but I wanted to end this section on one which fused my passions for doing a great deal, seeing through an epic project, and getting to work with my favourite brand (Disney) on my favourite film franchise (Star Wars).

Star Wars Families was a concept which 1854’s creative studio team pitched to Disney and won, in the most ambitious and valuable deal the studio had secured to date. In the build up to Star Wars: The Rise of Skywalker (the final film in the Skywalker saga), we commissioned 10 photographers and 10 filmmakers from 10 countries around the world to tell the intergenerational stories of what Star Wars meant to 10 families. The result was 10 photo essays and 2 movies we directed and edited for Lucasfilm/Disney to use in the promotional build-up to the film opening, telling Star Wars Families stories from the fan perspective.

The studio was profitable in its own right as a business unit but also formed one of the cornerstones of the 1854 Access membership platform, with members enjoying exclusive or early access to apply for commissions with international brands and charities like Disney, Panasonic, adidas, Californian tourist board, Leica, Malala fund and many more.

Education

I attended a local comprehensive school and was exposed to a diverse and interesting bunch of people, learning as much about life as I did about Maths & English. I later attended the University of Bedfordshire, graduating with BA (Hons) Accounting & Finance in 1994, and subsequently qualified as an accountant (ACCA).

Throughout my career I have been through a wide array of leadership development programs and self improvement courses. It is my view that you are always learning and that everybody and every situation has something to teach.

All words on this site are my own, other than the kind quotes which you can mostly find on LinkedIn. I am happy with my lot but always open-minded to new opportunities and collaborations, so let’s talk?

“Marc and I enjoyed a long working partnership of over 15 years joining as Incisive’s only accountant and leaving with his own business. Marc is a great manager of people, highly energetic, someone who is more than capable of not just talking the talk but also walking the walk. He is a strong presenter with very strong financial knowledge - all skills in my mind which make him the ideal person to run a new start-up company.”